For quite a few years now, millennials have been the target audience to test new outreach approaches in the mortgage industry, but it’s time to re-shift focus and start marketing mortgages to Gen Z.

If you’re one of those who lose track of numbers as the years go by, then thinking about the term “Generation Z” automatically conjures an image of high school students still a long way from the homebuying journey. While that is true for some – considering that the label “Gen Z” is often assigned to those born between the mid 90s to early 2010s, this also means that the oldest members of the generation are stepping into their late twenties!

We also need to consider that Gen Z grew up with the same economic uncertainties of their generational predecessors, all the while being the first generation considered digitally-native, so traditional marketing and persuasion aren’t going to suffice. Let’s take a look at what approach to use for advertising and selling your mortgage services to a tech-savvy and financially-independent generation.

Knowing Gen Z’s finances and priorities

Before going on to marketing mortgages to Generation Z, we need to understand the audience group better. The elongated economic expansion allowed more young people to have an easier entrance into the credit market than millennials. More and more, thus, have some sort of credit balance.

However, Gen Z is not being reckless about their financial choices. In fact, they are actively trying to avoid the mistake of being drowned in student loans for the rest of their lives and are also actively making plans to ensure they get good education and preparation for the labor market without being in debt. They’re also big on starting to save as early as possible.

Does this make them less prospective customers? Not at all, in fact, four out of five say they are positive about owning a home within the next five years due to more privacy, freedom, and long-term financial security.

More and more members of the group also have a prime credit score, making them ideal potential mortgage loan leads.

So, what can you use to make something like a “loan” fit into the category of financial stability?

The right timing

Younger buyers look for low interest rates. Although this is not something unique to Gen Z, it’s more likely they already have a plan in their head about the price point of their future home and the interest rate they’re willing to sign off on, so you’d want to leverage your marketing efforts for Generation Z during times when mortgage rates are falling rather than the opposite. What to do when interest rates are not falling? Don’t give up on Gen Z home buyers. They’re still out there and many are still in the marketing for a new home. Your selling points will have to change from low-rates focused to other benefits of working with you/your company.

Being informative and transparent

As mentioned, this generation is well-versed in technology, and they don’t skip their research. Offering a precise run-down of not only what plans you offer and at what rate (if you’re a lender) or services (if you’re a broker) is not enough. They want to be reassured even before giving you a call. Instead, provide examples and graphs on your website mentioning at what budget which loans would be most appropriate, or how the process of getting advice or a loan in your firm looks like from beginning to end. Give them something they can’t find on Wikipedia or the latest news article on mortgage rate trends.

Once you understand what you need to give and when, it’s time to delve into how.

Maxing out digital marketing

The world of real estate is already getting up to speed with using new technologies and platforms to market their services. But it’s easier to post a VR tour of a house than to try and integrate VR into mortgage. Here are a few tricks you can use to make the best out of digital channels and mediums for your mortgage business.

Social media and video

Scott Betley is a great example of how to achieve TikTok and Instagram fame through the power of fast-paced down-to-the-point content. Unlike traditional marketing where flat-out laying out your services in the best possible format is what’s going to secure you a sale, Gen Z will care about what your prices are AFTER you assure them you know your field. Scott uses his platform to answer FAQs circulating around topics like current mortgage rates, best loan plans, and upkeep costs, all in short 30-60 second comedy-sketch videos.

Scott Betley is a great example of how to achieve TikTok and Instagram fame through the power of fast-paced down-to-the-point content. Unlike traditional marketing where flat-out laying out your services in the best possible format is what’s going to secure you a sale, Gen Z will care about what your prices are AFTER you assure them you know your field. Scott uses his platform to answer FAQs circulating around topics like current mortgage rates, best loan plans, and upkeep costs, all in short 30-60 second comedy-sketch videos.

Although this seems like you’d be doing your job for free, the younger members of your target audience would much rather ask for your services for follow-up questions than starting with nothing.

Aside from TikTok and Instagram, Snapchat and YouTube seem to be the most visited channels by the group, so you can go with what feels most comfortable to you – choreographies on TikTok, or a professionally edited Youtube series.

Google search

Studies show that, when using search engines, Gen Z relies on long-tail keywords, as well as reviews and recommendations.

Studies show that, when using search engines, Gen Z relies on long-tail keywords, as well as reviews and recommendations.

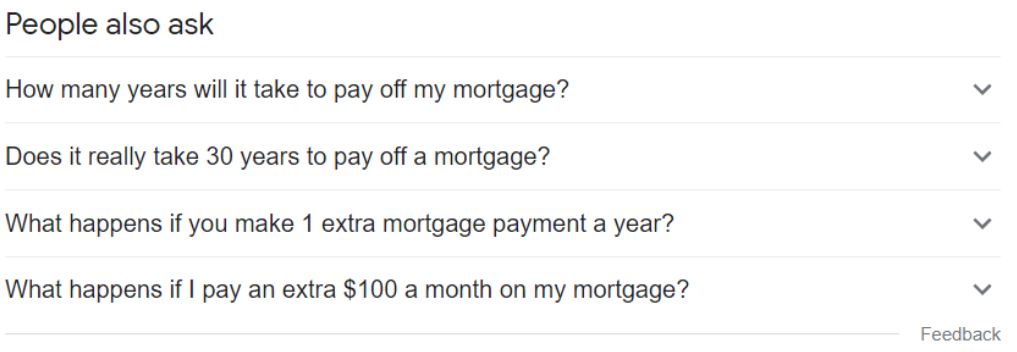

Two good ways you can leverage your authenticity on search for this target audience are using your Google My Business account as your main channel for reviews, as well as leverage your content optimization for a placement in the “People also ask” section.

In the mortgage industry, you may get a lot more visibility from Gen Z forming your titles and subtitles as questions and trying to rank for longer keywords and keyphrases that are popular search queries.

For example, opt for keyphrases like “pay off my mortgage” instead of just “mortgage payments”.

Influencer marketing

Around two-thirds of Gen Z consumers say that they made a purchase based on an influencer recommendation. You need to do some digging and identify the best partnership opportunities based on your target audience – someone whose audience has a good portion of people in their mid-twenties.

Around two-thirds of Gen Z consumers say that they made a purchase based on an influencer recommendation. You need to do some digging and identify the best partnership opportunities based on your target audience – someone whose audience has a good portion of people in their mid-twenties.

Look into influencers that are close to your own niche, like personal finance advisors, real estate agents, or even perhaps career influencers as both home-buying and career-building fall under long-term security plans.

Then, also identify which loans you want to advertise – obviously, not refinancing loans! Remember that Gen Z is fresh to the homebuying market.

PPC advertising

Research shows that the generations on the brink of the new millennium are the most diverse generation in history, and they value the same approach in advertisement. If you want to advertise to Gen Z, you can’t skip inclusivity.

Promoting more women, immigrants, POC, and members of the LGBTQ+ community in your advertising, as well as actively working on supporting inclusive causes, is something every business should start implementing – if they haven’t already. Make sure your advertising reflects your brand values (and make sure your brand values support good causes).

Members of this group also spend an average of 3 hours a day on their phones, with the average attention span being 8 seconds. You need to get acquainted with mobile pay-per-click fundamentals, all the while promoting both your services and core values in such a way that it takes no longer than 8 seconds to absorb. Sounds like a hassle, but, out of all age groups, GenZ is the most likely to be influenced by mobile ads, so better start learning how to leverage PPC for your mortgage business.

What’s your biggest struggle when it comes to adapting your marketing strategies to newer generations?