With the whole world turning digital, secure file sharing has become increasingly more important. One can no longer anticipate that their sensitive information is being stored under lock and key, with the only possibility of a leak being that of a physical break-in or an inside job. An intruder can now be someone with no proximity to you, targeting data at random from the comfort of their own home.

Establishing a secure file sharing system instead of asking for confidential data to be sent over via TransferWise, DropBox, or in an email attachment is crucial for your business integrity, as any leaks in data would be your responsibility. Moreover, with all the talk going on around online privacy in newly-encouraged remote work models, using the everyday means of file sharing in the mortgage industry may portray you as unreliable.

Here’s how going the extra mile, when it comes to secure file sharing, will benefit your mortgage business.

Sticking to compliance requirements

There is a vast majority of file-sharing and cloud-based storage software solutions available on the market today, however, most of them don’t meet the requirements for handling financial data online. Establishing end-to-end encrypted email funnels eats up time and is not fool-proof, while hosting your own data server can be an extremely costly venture.

It’s shocking to know that 70% of lenders are opting for risky file-sharing practices as a means to avoid the hassle, most often utilizing email and fax as opposed to a secure file sharing portal.

While you can’t prevent yourself or your business from becoming the target of a skilled hacker attack, using email as a means of acquiring and sharing documents, such as scanned IDs and bank statements, means you’re willingly risking your client’s data by avoiding compliance requirements. This could make you equally as responsible in the eyes of the law as the person who initiated the cyber attack.

Adding a secure and compliant file-sharing platform as a medium not only lowers the risk of an attack happening in the first place, but saves your integrity and conscience knowing you have indeed done everything you can in order to protect your client’s data.

The trust-building factor

There have been more than 10 million records of incidents involving data breaching. We’ve seen it happen in large corporate companies like British Airways, where data from more than 400,000 customers was leaked back in 2018, Google Play’s ransomware incidents, and Amazon’s email list insider breach.

In 2019, First American Financial also leaked more than 800 million documents containing financial data relating to real estate transactions. It’s news items like these that put a smear on the housing market that will last long after the financial settlement has been made.

All of this makes customers and clients uneasy about sharing personal documentation on any virtual platform, especially when the data involved is something as sensitive as personal financial information. In the mortgage industry, lenders building trust with borrowers is the foundation of business growth. If you let your clients know that you have a secure end-to-end encrypted software that you utilize for any virtual documentation, you’ll instantly gain a competitive advantage above those who don’t, presenting your business as the more trustworthy option.

Streamlining your workflow with secure file sharing

Secure file sharing options allow you to get more comfortable with the kinds of files that you can share with your co-workers, especially working in a remote team. This in turn allows you to establish processes that will streamline your workflow and give you back some time you’d otherwise have to spend on administrative tasks such as document organization.

Instead of having to re-share bits and pieces of dedicated documentation with your employees, a secure file sharing software will allow you to give access to relevant files to whomever needs it. Likewise, borrowers, lenders, and even partners can share one cloud storage space, making hand-offs and update notifications easier.

For supervisors, managers, and business owners, there’s an added benefit of being able to remotely wipe data from any folder by yourself, instead of having to blindly trust your employees and partners (or trying to get into their laptops to wipe the data manually).

The role of SecureShare

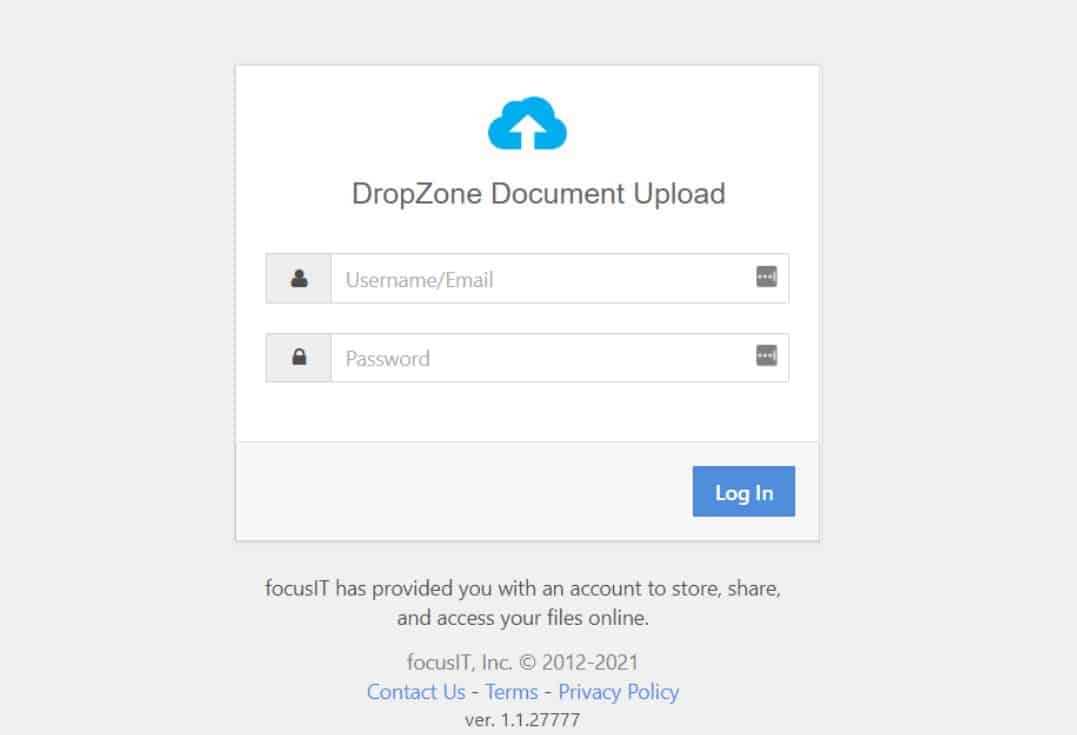

SecureShare was introduced at focusIT as a mortgage-industry exclusive SOC 1, SOC 2, and GLBA compliant software solution for secure end-to-end encrypted file sharing. With no setup fees and no hosting costs, SecureShare provides an easy-to-use and easy-to-manage dropzone at the cost of only $10 per user per month. Your files are backed up on a daily basis with a premium customer support team at your service, so even if you accidentally remove some files, you can contact your support team and have them retrieved in due time.

Additionally, you can create custom portals as a landing page for customers or partners to drag and drop files without needing to have a profile themselves.

Contact focusIT today to set up SecureShare, or get more information about our product.

Recent Comments