On our blog, we’ve already touched on how crucial it is for loan officers to enforce routines and practices for better time management. Time management is an important skill to master for all loan officers, but it’s non-negotiable for mortgage business owners, managers, and independent LOs. Not only will unproductive use of your time result in your business stagnating and your profits lowering, but you may also experience severe burnout posing a threat to the future of your entire career.

Being busy with day-to-day operations and working hands-on with your client’s loans, you may forget to send out a reminder, a newsletter, or reach out to a partner, which will all lower your referral marketing potential and buyer experience.

There is various software for automating alerts, alarms, and email marketing available, so you don’t have to clutter up your calendar and copy-paste through Google Sheets. However, utilizing different software for different purposes can be a pain in the neck to manage, which defeats the purpose of “automation”.

If only there was a one-stop-shop where you could set everything up and have it do the work for you… Well, there actually is — and it’s called Pulse. Here’s a rundown of what Pulse can do for you and the benefits it will have on your mortgage business.

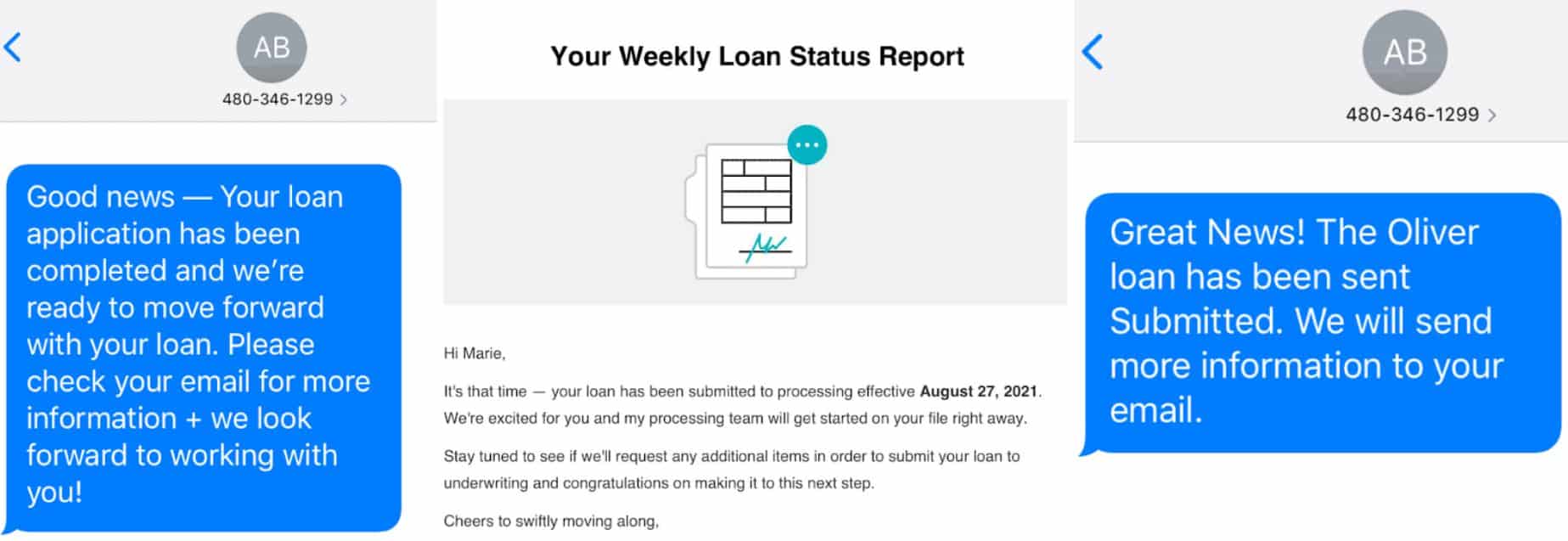

Progress Reports

Clear communication is one of the key trust-building factors for a loan officer. Your clients will appreciate you reaching out to them and informing them about the status and progress of their loan application without them needing to call you.

With Pulse, changes in the loan status will trigger automated emails and text messages to the processor, borrower, co-borrower, buyer’s agent, and seller’s agent, keeping everyone in the loop without any additional fees.

Automations cover every step of the loan application, from the initial steps and processing, all the way through to funding and closing.

Post-Close

In the mortgage industry, closing out a loan doesn’t mean that’s the end of the road for you and your client. They may want to purchase a new home or refinance sometime in the future, which is why you need to ensure that you nurture your relationship with your past borrowers and stay top-of-mind.

In the mortgage industry, closing out a loan doesn’t mean that’s the end of the road for you and your client. They may want to purchase a new home or refinance sometime in the future, which is why you need to ensure that you nurture your relationship with your past borrowers and stay top-of-mind.

With Pulse, you can send up to five emails in the post-close process, either as a check-in to see how they’re doing in their new home, or providing relevant informational content for new homeowners.

You can even go a step further and check in with your borrowers on their 1-year loan anniversary. It’s a fun way to introduce more personalization to your customer service and marketing strategy.

Choose between the traditional route (an email) and sending a text message.

Birthdays and Holidays

Working as a mortgage loan officer, you may even sometimes forget your own birthday, so remembering the birthdays of each and every one of your clients is certainly out of the question… But Pulse remembers EVERYTHING.

Birthdays, New Year’s, Thanksgiving… Pulse can send up to 8 personalized holiday emails + virtual birthday cards to help you connect with your clients and prospects on a more human level. If only we could get Pulse for our friends and family…

Increasing Awareness

If you had a potential borrower contact you for more information and then disappear, it’s more than likely they’re researching all their options and they haven’t yet given you a hard pass.

If you had a potential borrower contact you for more information and then disappear, it’s more than likely they’re researching all their options and they haven’t yet given you a hard pass.

Follow up with these leads by automating a drip campaign. In short, a drip campaign is a set of emails with bite-sized info and perks about your business that are sent to your leads with some time in between each email (from a few days to a few weeks).

This way, you are putting yourself out there for your prospect to read more about you without sending them a ton of material all at once and cluttering their email box with what will essentially look like spam.

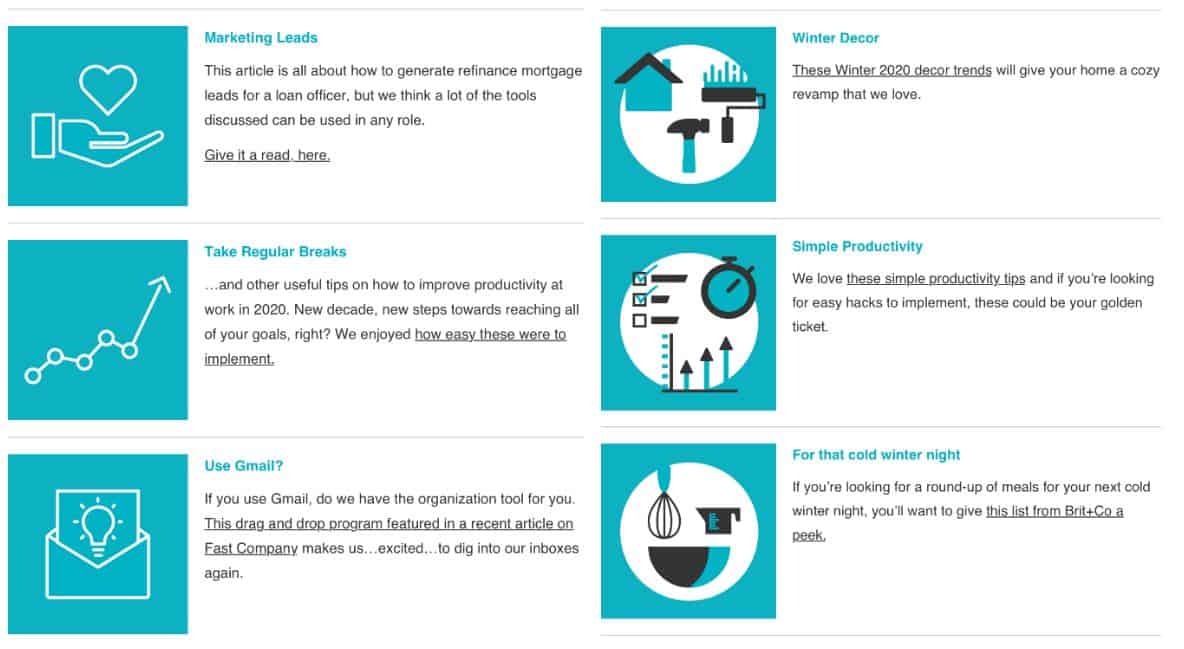

Monthly Newsletters

Regardless of whether someone is your current client, a past borrower, a prospect, a partner, or potential partner, introducing email newsletters is the ultimate way to keep in touch with all your partners and leads. Keeping the content informative and catering it to different audiences is the best approach.

Pulse pulls content from different sources and filters it by target audience: borrowers or realtors. You can choose to send out one completely automated newsletter to each group per month.

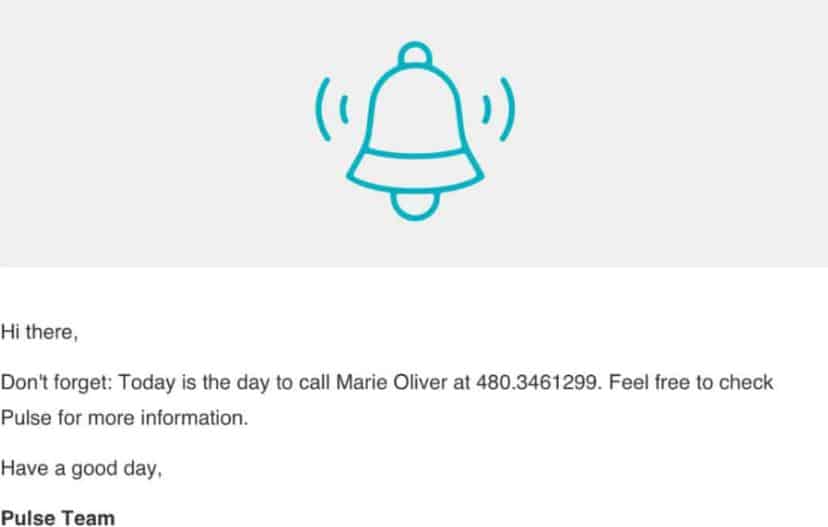

Before You Forget…

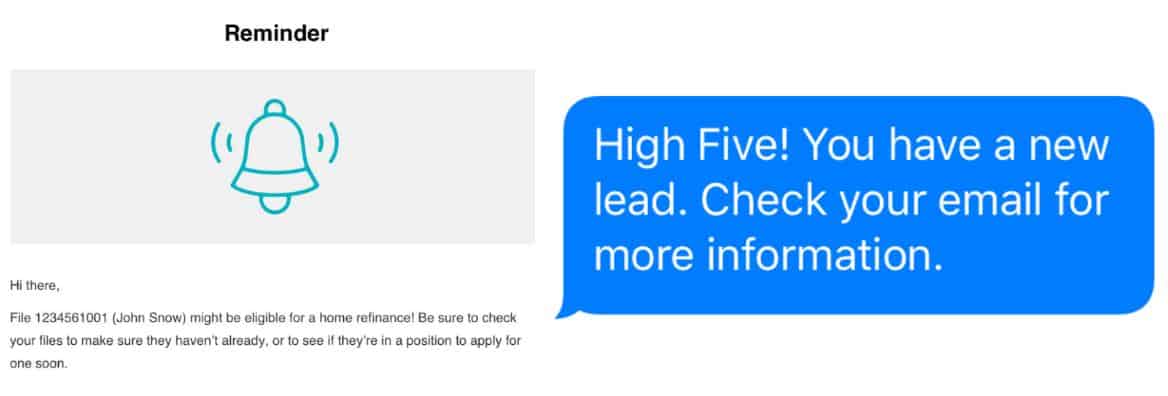

Pulse isn’t only here to remind you to keep up a good relationship with your partners and borrowers. Pulse will remind you of any upcoming calls, events, and tasks, much like a Google Calendar; the only difference is you don’t need to manually put your reminders in.

Not only that, but Pulse also reminds you of leads you haven’t followed up on or prospects coming your way. Think of Pulse as your own personal pocket loan officer assistant (and with the encouraging undertone of its messaging, you’ll never even notice Pulse isn’t actually human).

Sound Intriguing?

If you’re a loan officer and could use a helpful buddy like Pulse in your life to keep you on top of all important dates and tasks filling up your schedule, then you’re in the right place.

We have examples of all text and email automations Pulse offers available for you to explore – that’s an impressive 62 emails and 56 text messages!

Have more questions? Feel free to contact our sales team. We’re always happy to help.

Have you used any software to automate your email marketing and reminders? How much time did it give you back in your day? Sound off in the comments below!

Recent Comments