The minute you get your first client, be it as an independent contractor or as a startup, you have officially opened the doors of your sales department. However, “selling” (no matter at what magnitude or quantity) and “having a sales pipeline” are two very different things.

Some call it a pipeline, others call it a funnel, and some just call it a process. No matter what you name it, any company that uses data to evaluate how well their business is doing (and what areas show room for growth) has some type of sectioned lead and sales management overview.

The sections of a mortgage sales pipeline can involve many different elements from the point of contact to the point of sale; depending on the client, the property, and the type of purchase or refinancing application.

Knowing what metrics you can track, how you can chunk information, how you can present and filter this information, and what it reflects in terms of your business growth are all key elements to making the most out of your sales process and improving your mortgage business’ cost-efficiency.

Let’s dive deeper into the topic of why having a sales pipeline is important for every mortgage business.

Tailor your business goals to your sales pipeline

Having a clear and measurable sales pipeline is the foundation of every successful business. Without it, you’re missing the key building blocks that allow you to set attainable goals and KPIs within your marketing, sales, and overall business growth strategies.

What’s important to note is that, unlike other industries, closing a contract in the mortgage industry is not the end of your sales funnel. It isn’t as black and white as “lead obtained” or “loan closed”, either. The end of your pipeline should be funded loans, but every other cog in the loan origination process can be measured. Each also leads to different results that are (or are not) in accordance with your business goals.

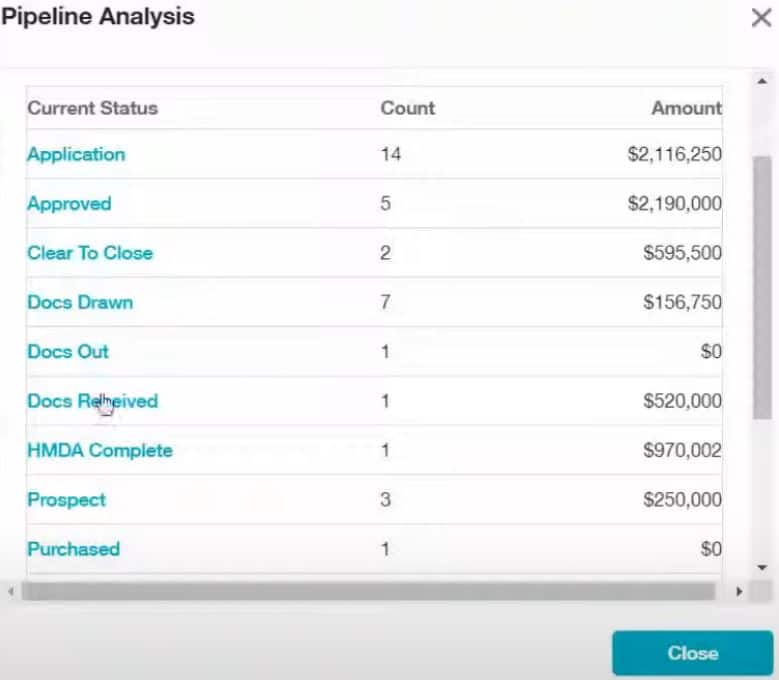

But, of course, to have data-driven business goals, you first need to have a means of tracking your data. Let’s say you’re aiming to attain mortgage industry benchmarks of converting 25% of your leads into applications. How can you know you achieved this goal if you track each lead status individually instead of having a cumulative overview of the number of prospects who reached out to you versus the number of borrowers who proceeded with the application?

You can decide which numbers you want to pay extra attention to in your sales pipeline and tailor priorities and goals in accordance with where your business is standing right now. Determining your mortgage business is successful does not always boil down to having enough leads and closing enough contracts and loans to be profitable. It can imply all the steps in between that also reflect on your business reputation, borrower satisfaction, and success rate:

- Despite having the desired number of funded loans, how many loans were denied from the total number of applications?

- How many loans are clear to close within the targeted timeline of the borrower?

- What’s the total amount of funding your closed applications add up to?

Ask yourself specific questions, set specific goals, and lay out your sales funnel in such a way that your questions can be answered using sales data.

Use sales data for team performance tracking

Your team’s sales performance is a crucial point to keep an eye on for mortgage business owners who delegate the actual work to individual loan officers.

By laying out all leads, open conversions, progress updates and the number of closed loans, you can get a clear picture of how each of your LOs is performing.

If one takes longer to get the ball rolling but closes out more applications in the end, that’s much more sustainable and cost-effective for the business than an LO who kicks off the application process within no time, but loans get declined or clients drop off mid-process every so often.

This is not to say you should penalize lower-performing loan officers, but more so get a clearer picture of what is and isn’t working in your sales tactics. If taking more time to “bond” with the client in the kick-off stages means they will be more cooperative and take initiative in terms of sharing and laying out their information later on, as well as be more confident in their loan officer choice, then this is a best practice that should be implemented as a sales tactic for all LOs on your team.

Automate and streamline your sales pipeline with software

If you’re operating on loan origination software solutions like Calyx, then both overviewing your sales and creating a sales pipeline are manual processes.

If your business is kicking off and leads are coming in on a regular basis, then you would need to delegate full-time hours just to have someone keep up with loan officers (and keep the sales sheet up-to-date in return).

If this doesn’t sound like the best use of your staff’s time, then turn-key software solutions like Pulse might be. Not only is introducing software a way to streamline and automate the sales process to cut down on manual work, but it’s also a better way to present your data.

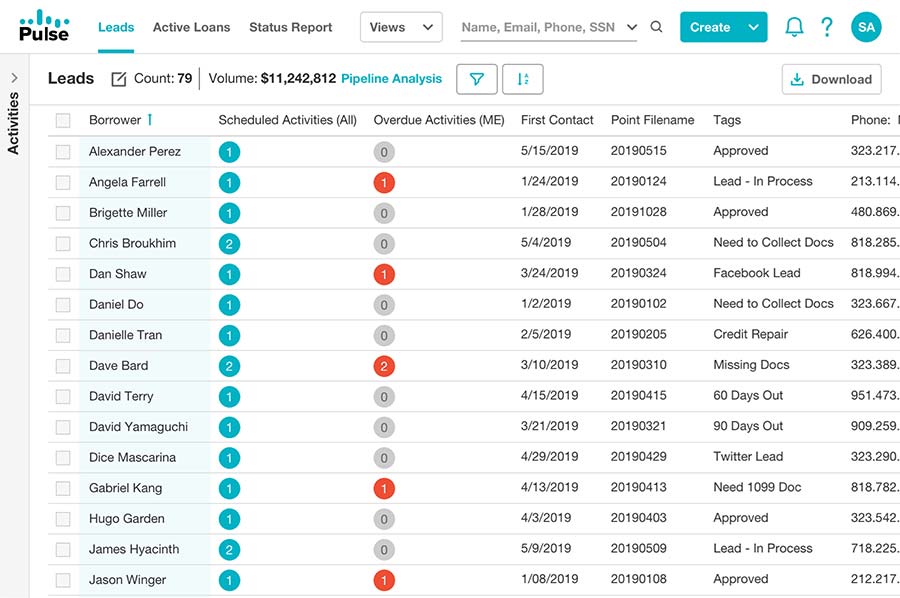

Instead of needing to use keyphrases to code your filtering process on a Google Sheet, you can use application statuses pulled directly from your loan origination and processing system (Calyx Point and PointCentral in the case of Pulse) and filter them accordingly, or add custom tags and flags to keep an eye on a hand-picked batch of prospects separately. Filters don’t apply to only loan statuses, but also borrowers, co-borrowers, loan officers, and even referral sources so you can have all information on your prospects, clients, employees, and partners all laid out in one place.

Additionally, what turn-key software plugins like Pulse ensure is that every user in your company is focusing on the same data, and even approaching notifications, follow-ups and emails using the same templates. This gives a more accurate insight on team performance as key variables in marketing and partner-borrower-lender communication stay the same.

Pulse allows you to export all selected data from your LOS (yes, notes included) to cut down on your time preparing reports.

The best thing? You needn’t set up Pulse by yourself. Simply contact focusIT with your business information and receive login details via email — it’s that easy!

How have you been managing your sales pipeline thus far? Share a comment below, we’d love to hear your thoughts!

Recent Comments